- Uswitch.com>

- Mortgages>

- Studies>

- 50+ UK rental market statistics 2024

UK private rental statistics 2024

This page includes relevant private rental market statistics for 2024, such as demographic stats, the regions with the most private rental homes, and the average UK rent per month.

Just like the housing market, the UK private rental market has been volatile in 2024. With everything from Covid-19 to the cost of living crisis affecting costs in recent years, rent has been one of the many aspects of day-to-day life that has accelerated for many people.

With the state of the economy preventing millions from being able to afford their own mortgages, the trajectory of the rental market could play a pivotal role in the lives of many people across the UK for years to come.

Our research collates the latest UK rental statistics for 2024, to analyse trends, assess how rents have changed over time, and make predictions about the coming years.

Overview: Top 10 UK rental market statistics 2024

Almost a fifth (18.8%) of UK homes are privately rented, as of 2023.

The median average cost of rent in England was £850 in September 2023 – a 3% rise from April 2023.

London residents paid at least 50% more for rent on average than anywhere else in the UK, with average costs of £1,625 per month.

The North East had the lowest monthly rents at £550 – 15% lower than any other region.

The average UK tenant spends around two-fifths (39.1%) of their monthly income on rent.

The annual change in UK rental prices was +6.2% in January 2024.

The annual change in London rental prices was 0.7% higher than the UK average for January 2024.

More than two-thirds (67%) of landlords reported an increase in tenant demand in Q2 2023.

The average price of UK rent is forecast to rise 17.6% between 2023 and 2028.

The percentage of landlords reporting rental arrears from tenants was 35% in Q3 2023.

How many people rent in the UK?

With the cost of buying a house unattainable for large sections of the UK population, the demand for rental properties has understandably increased. In 2000, 10% of homes in England were privately rented. By 2017, this had more than doubled.

As of 2022, this figure dropped slightly, to around 19.1%, meaning the overall number of privately rented properties in the UK stood at just over 4.6 million. In 2023, this decreased to 18.8%, with the overall figure still standing at close to 4.6 million.

According to a 2022 report by Property Mark, 73% of agents reported an increase in the number of tenants renewing their rental contracts over the last year.

Furthermore, an average of 63 new prospective tenants registered per branch in December 2023 – down from 86 in November (-27%) and 121 in August (-48%).

Despite this, there were only an average of nine properties per branch made available for rent, meaning there are around seven new prospective tenants for every new property available. Given this lack of stock on the rental market, it’s little surprise that tenants are choosing to stay in their current accommodation rather than move.

In addition to this, more than a third (35%) of Property Mark’s member agents reported month-on-month increases in rent prices in December 2023. This is a 4% rise from the 31% recorded the previous month, but a substantial fall (17%) from the 52% recorded in September 2023.

Members of Property Mark reported an average of nine properties available to rent per branch in December 2023. This figure is in line with the December 2022 figure but falls from the 11 recorded in September 2023.

According to the RICS Residential Market Survey, tenant demand started to slow in late 2023, with almost a fifth (17%) of respondents reporting an increase in the three months leading to December. This was the fifth straight month this number fell, down from a peak of 59% in July.

With regards to supply, a net balance of +1% of new landlord instructions was reported for December 2023. As a result of the mismatch between supply and demand, half (50%) of respondents expect rental prices to increase in the following three months.

How has tenant demand changed over time?

Recent UK rental market statistics found more than two-thirds (67%) of landlords in Paragon Bank’s quarterly survey reported an increase in tenant demand. Of these, more than two-fifths (44%) felt demand had significantly increased, with just under a quarter (23%) reporting slight increases.

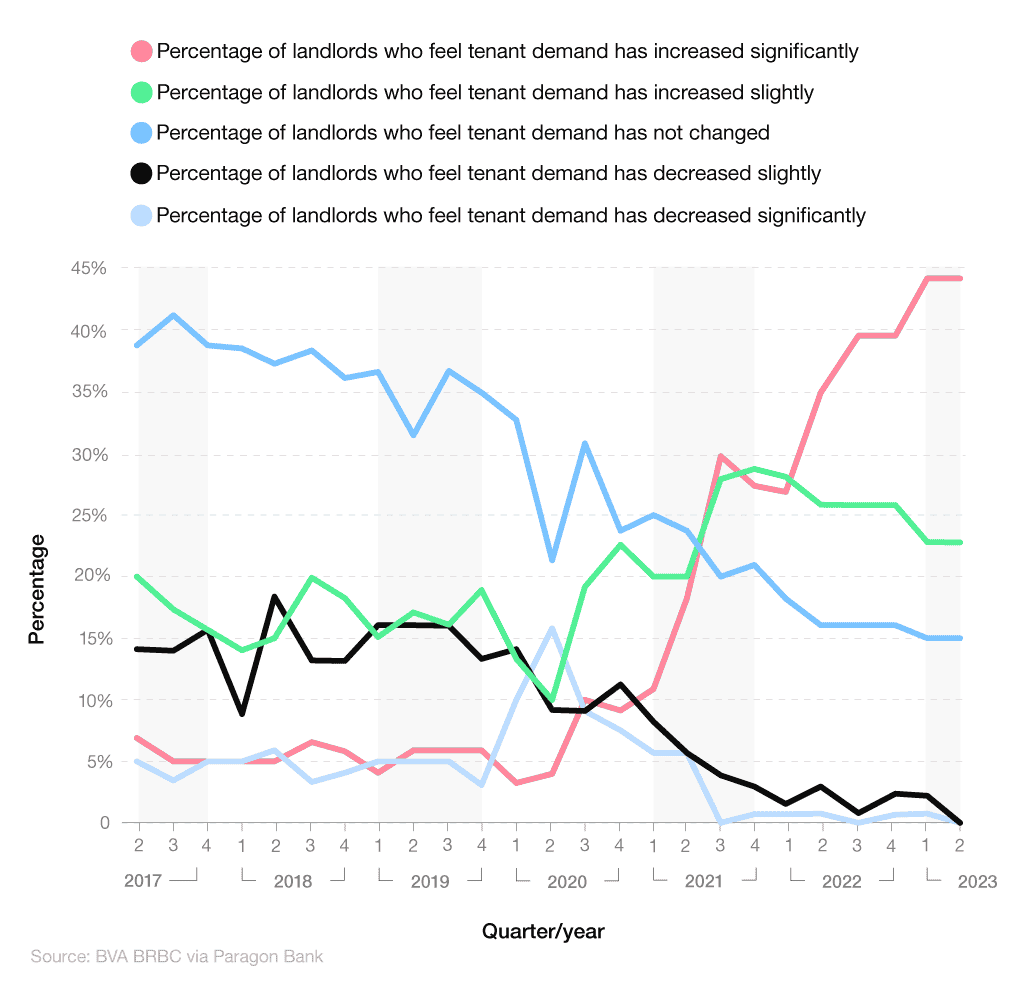

A breakdown of the changes in UK tenant demand between 2017 and 2023

The number of landlords reporting increases in rental demand has accelerated since Q1 2017, when just over a quarter (27%) of landlords reported rises. This number dropped to 13% by Q1 2020, with only 3% citing significant increases in this quarter. These figures increased rapidly from mid-2021 onwards, reaching 58% by Q1 2022 before hitting 69% by the final quarter of that year.

Conversely, the number of landlords reporting a decrease in demand fell sharply from highs of one in four (25%) in Q2 2020 to less than 1% for Q2 2023.

How has private rental demand changed across the UK?

London experienced the greatest increase in tenant demand in Q2 2023, with more than nine in 10 landlords (91%) citing an increase in demand. Of these, more than two-thirds (67%) claimed they’d experienced a significant increase, with less than a quarter (24%) citing a slight increase.

London was followed by the East Midlands, where 87% of landlords reported an increase in tenant demand. This was the only other total above 85% and was 5% more than any other region.

A regional breakdown of the changes in tenant demand across England and Wales in Q2 2023

| Region | Percentage of landlords who feel tenant demand has increased significantly | Percentage of landlords who feel tenant demand has increased slightly | Percentage of landlords who feel tenant demand has not changed | Percentage of landlords who feel tenant demand has decreased slightly | Percentage of landlords who feel tenant demand has decreased significantly |

|---|---|---|---|---|---|

| East of England | 56% | 24% | 1% | Less than 1% | Less than 1% |

| East Midlands | 51% | 36% | 11% | 3% | Less than 1% |

| Yorkshire and the Humber | 48% | 26% | 20% | 3% | 2% |

| Central London | 44% | 36% | 17% | 1% | Less than 1% |

| North East | 33% | 36% | 25% | 6% | Less than 1% |

| Outer London | 67% | 24% | 7% | 1% | Less than 1% |

| South West | 54% | 26% | 18% | 2% | Less than 1% |

| Wales | 54% | 28% | 18% | Less than 1% | Less than 1% |

| North West | 52% | 28% | 18% | 2% | Less than 1% |

| South East | 49% | 30% | 18% | 3% | Less than 1% |

| West Midlands | 42% | 29% | 28% | Less than 1% | Less than 1% |

(Source: BVA BDRC via Paragon Bank) At the other end of the scale, only 69% of landlords in the North East reported an increase in tenant demand – the lowest of any region. This was almost a quarter (23%) lower than the London figure, with only a third (33%) of North East landlords experiencing significant increases.

The North East also had the highest number of landlords experiencing decreases in demand (6%), followed by the East Midlands (3%) and South East (3%).

What is the average cost of rent in England?

The latest UK rental market statistics found that the median average cost of rent in England was £850 between October 2022 and September 2023. This represents the highest figure to date and is a 3% increase on the average recorded between May 2022 to April 2023 (£825).

Which region pays the most for rent in England?

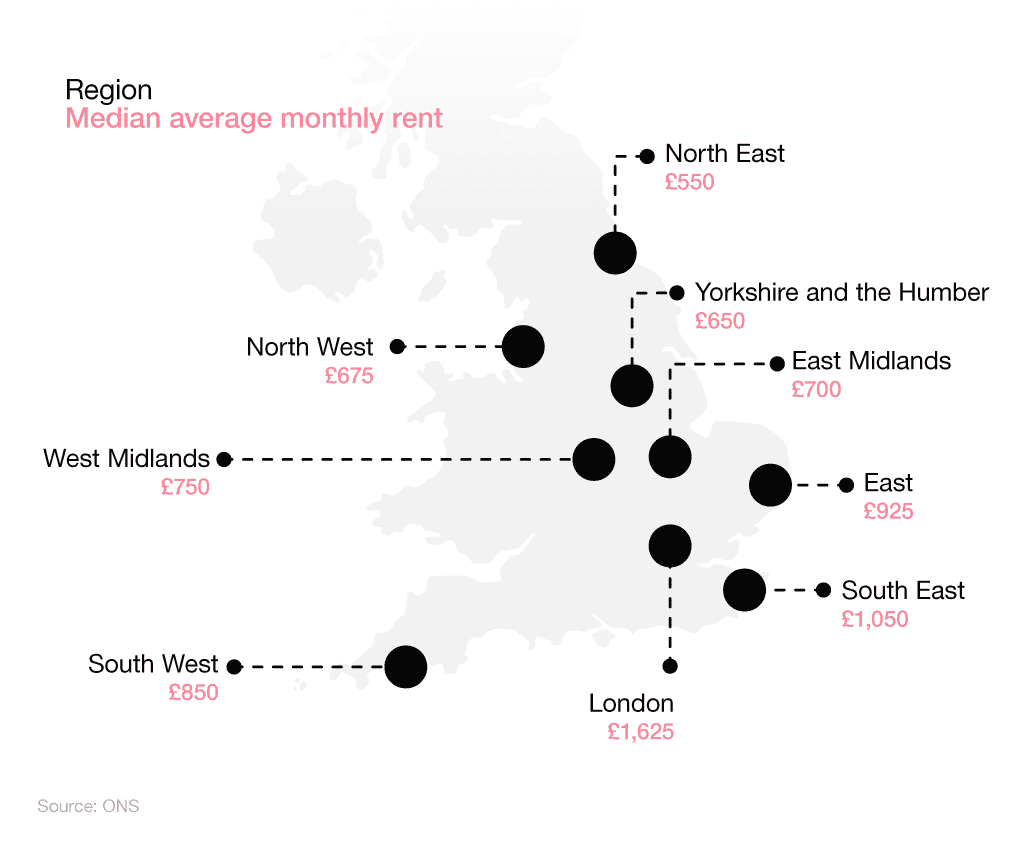

Private rental market statistics show that London residents typically paid the most rent of any region in England, with median average costs of £1,625 per month between October 2022 and September 2023.

This represents an increase of more than 8% from five months previously and means that the average rent in London per month is around 55% more than the next most expensive region (the South East) and 141% more than the North West.

A regional breakdown of the median average monthly rent in the UK (October 2022-September 2023)

The South East has the next highest average rent per month (£1,050), followed by the East of England (£900). These were the only other regions aside from London with average rents of £900 or more.

At the other end of the scale, the North East is the cheapest place to rent in the UK, with average monthly costs of £550 – 15% lower than any other region. This means that North East tenants pay around two-thirds (66%) less than those in London and 48% less than residents in the South East, on average.

How have UK rental prices changed over time?

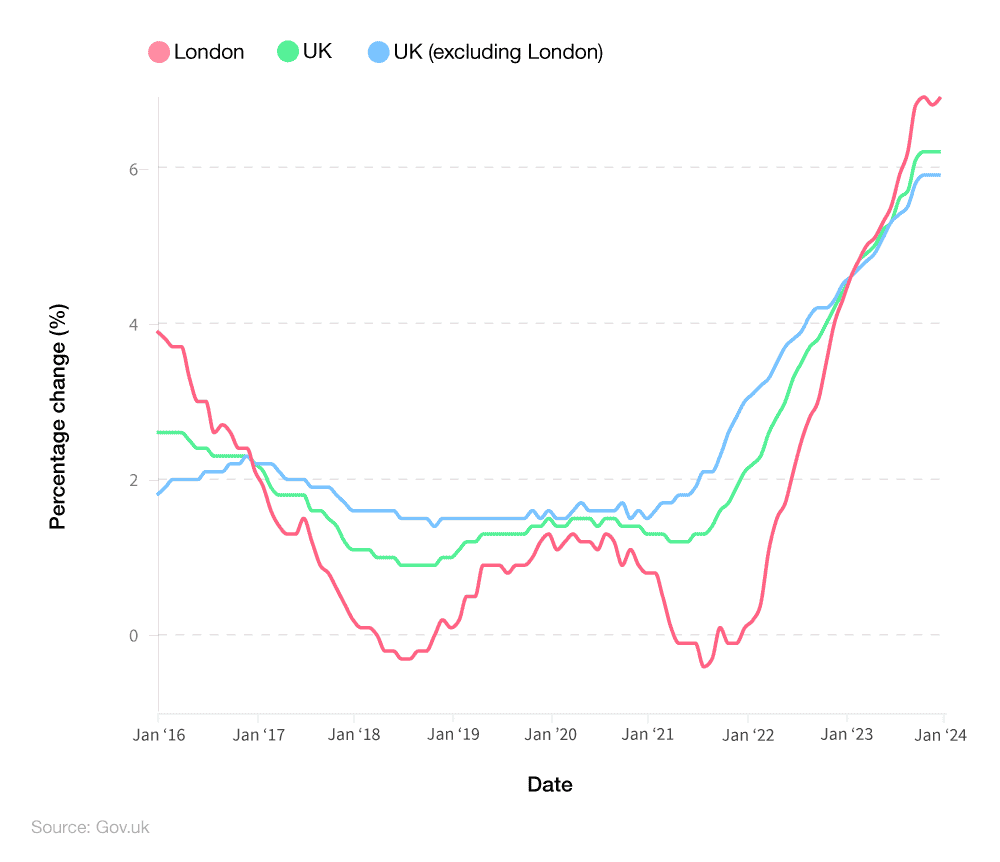

The 12-month price change in the cost of private rental charges for UK properties initially was on the decrease between 2016 and 2019, from +2.6% in Q1 2016 down to a low of +0.9% in Autumn 2019. Since June 2021, the annual change in rent prices has rapidly risen from +2.1%, to a peak of +5.3% in July 2023.

A breakdown of the 12-month percentage change in UK rental prices between 2016 and 2024

February 2017 was the first time in recent history that annual changes to the average UK rent exceeded the national average, and it remained that way until February 2023.

In June 2023, rent increases for areas excluding London were +5.2% – slightly below the national average. This increased to +5.9% by January 2024 but remained 0.3% below the national average of +6.2%.

London, by contrast, has seen major changes over the last seven years. In January 2016, the 12-month change reached a high of +3.9%, before heading on a rapid decline to -0.3% in the summer of 2018. Fluctuations since then have floated above and below 0%. However, since January 2022, they have remained positive and increased rapidly up to +5.5% in July 2023. As of January 2024, the 12-month change in rental prices in London stood at +6.9% – 0.7% above the national average.

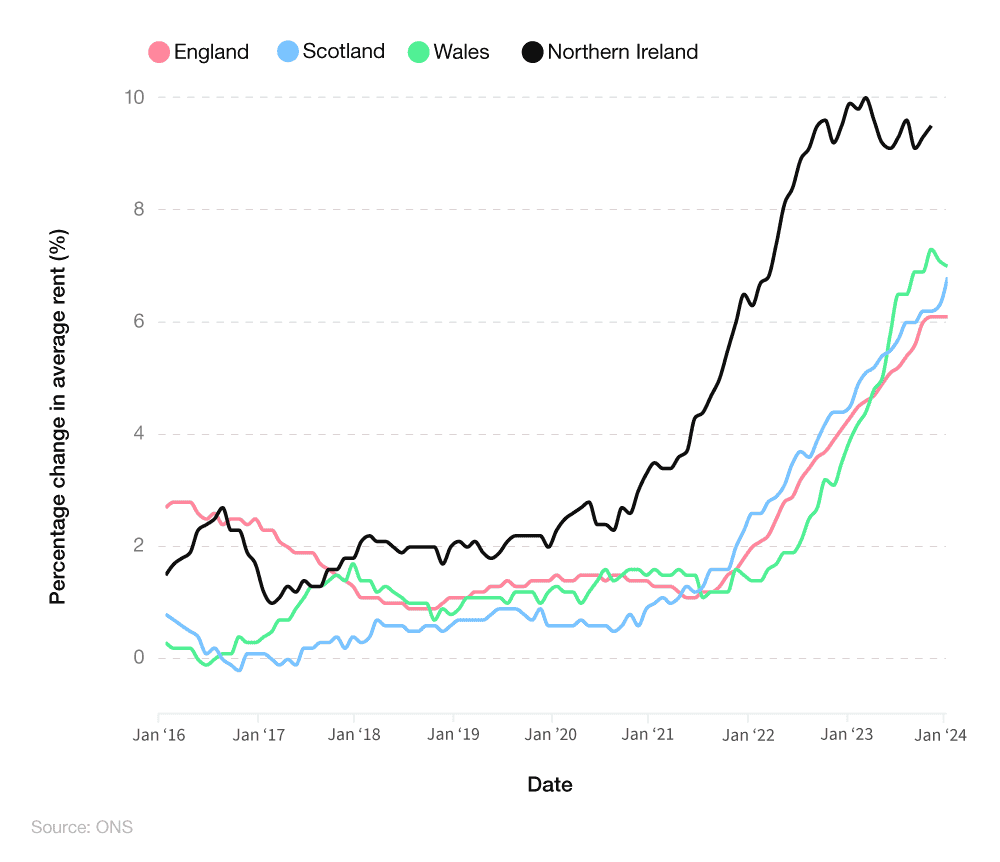

A breakdown of the 12-month percentage change in the average rent in the UK across different countries (2016-2024 )

Since 2016, most countries in the UK have remained positive for their 12-monthly change in rent prices. This is with the exception of Scotland, which saw slight fluctuations above and below 0% between September 2016 and May 2017.

All four nations have generally experienced low and steady change over the last six years. Since October 2017, Northern Ireland saw the biggest increase in annual rent change and has retained this title ever since. In November 2023, rent was 9.5% higher in Northern Ireland compared to the previous year. Comparative figures for the rest of the UK were +6.1% (England), +7.3% (Wales), and +6.2% (Scotland).

Though Northern Ireland’s figures for January 2024 were unavailable, rent prices in the other three UK nations went in different directions. England’s annual rises remained unchanged at +6.1% – 0.1% below the average UK rent growth. However, Wales' rental growth dropped to +7%, while Scotland’s rose to +6.8%.

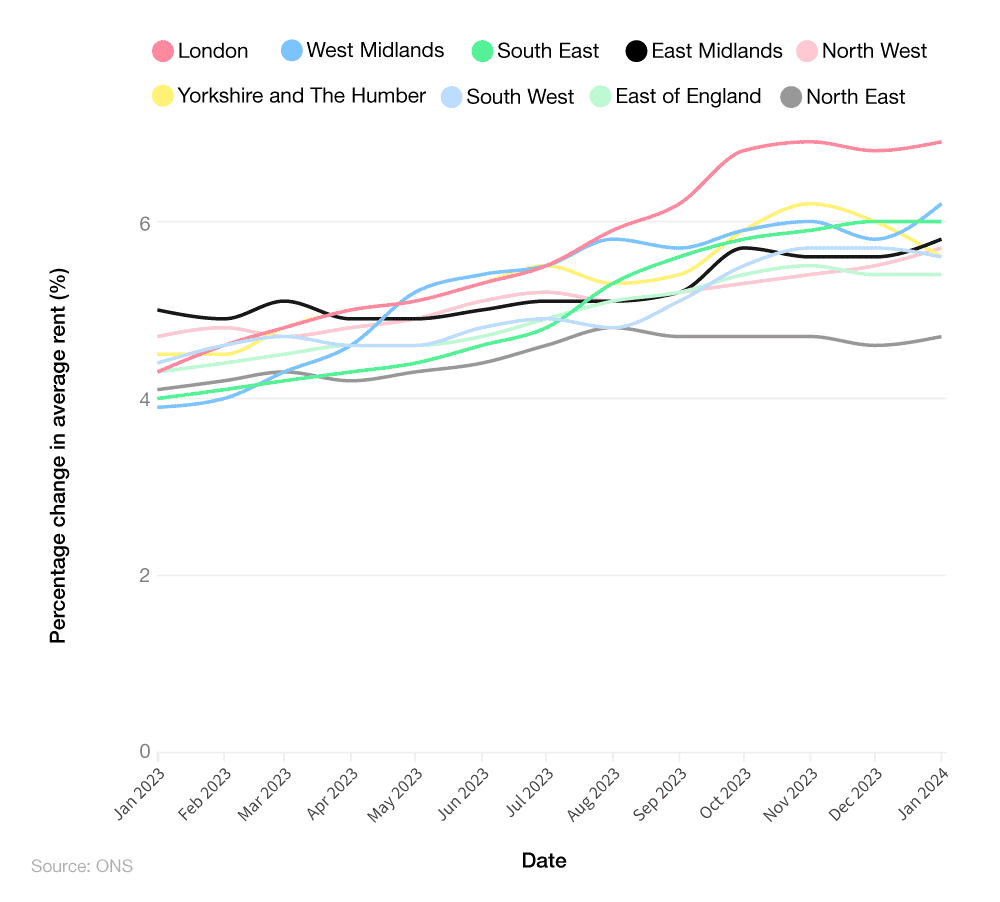

Which English regions have seen the biggest increase in private rental prices?

Between January 2023 and January 2024, there were some regional variations in the changes to rental prices. All parts of England saw growth, albeit at varying levels and rates. For example, London, and the South East experienced the biggest increases, with rises of 6.9% and 6.2%, respectively.

A breakdown of the percentage change to annual rent in different parts of the UK from January 2023-2024

The North East experienced the smallest rent growth over the last 12 months, at +4.7% in January 2024. This is compared to +5.4% in the East of England and +5.6% in both the South West and Yorkshire and the Humber.

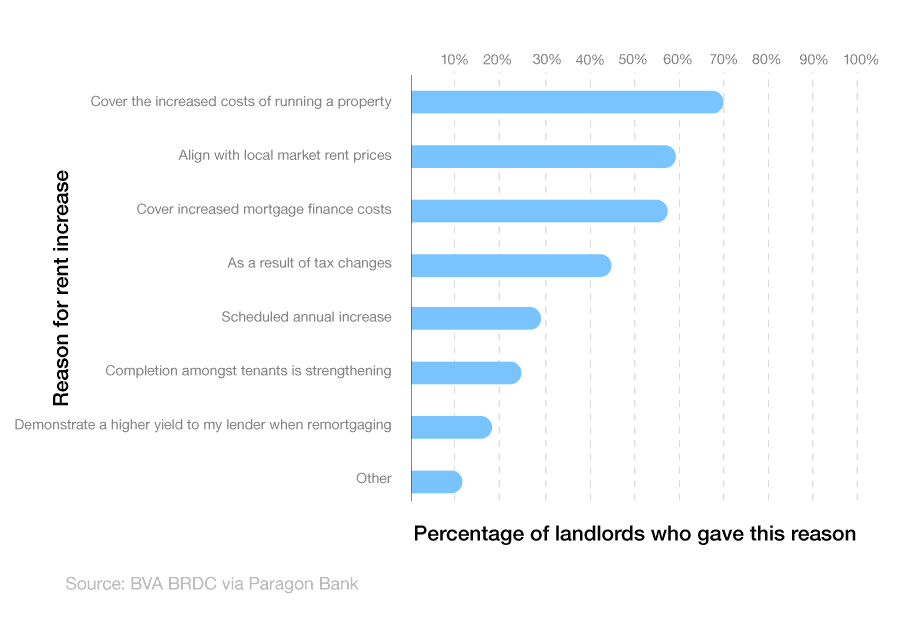

Why is rent going up in the UK?

Recent rental market statistics found almost three-quarters (74%) of landlords cited the rising costs of running a property as one of the reasons they plan to raise rents in the next six months. This was the most commonly referenced factor in the survey by Paragon Bank and the only reason given by more than 60% of respondents.

The next most common reasons given were the desire to align with local market rents (59%) and to cover the increased costs of mortgage finances (57%). These factors were the only others that were cited by more than half of the respondents and were at least 12% more common than the remaining reasons.

At the other end of the scale, less than a fifth (18%) of respondents claimed they were raising rents to demonstrate a higher yield to lenders when remortgaging. This was more than 50% lower than those who referenced rising running costs and 6% lower than any other factor.

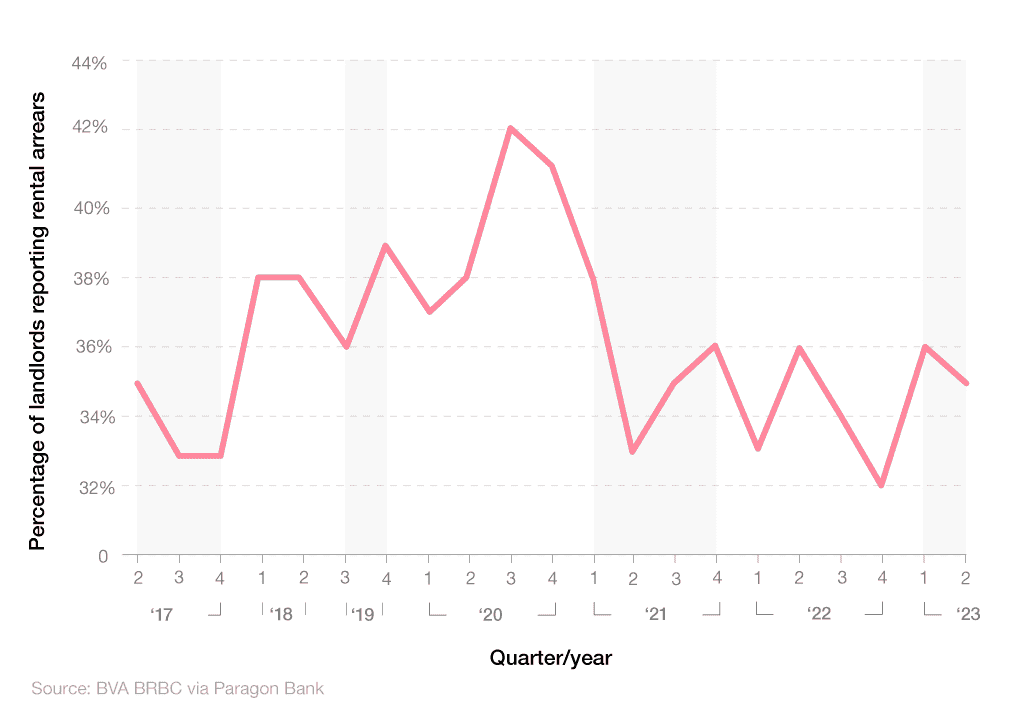

How has the percentage of rental arrears reported by UK landlords changed over time?

The percentage of landlords reporting rental arrears from tenants stood at just over a third (35%) in Q2 2023. This represents a 1% fall from the previous quarter but a 3% rise from Q4 2022, when the figure stood at 32%.

The number of landlords reporting rental arrears fluctuated from 30-39% throughout 2017 and 2018 before reaching 40% in Q2 2019. Numbers stayed around the 40% mark for the next year, peaking at 42% in Q3 2020 before falling to 33% in Q2 2021.

Since then, the numbers have remained stable, with the latest figure for Q2 2023 marking the ninth successive quarter in which they have fallen between 32% and 36%.

Compare our best deals on tenants' home insurance and tenants' contents insurance to give you the cover you need while renting a home.

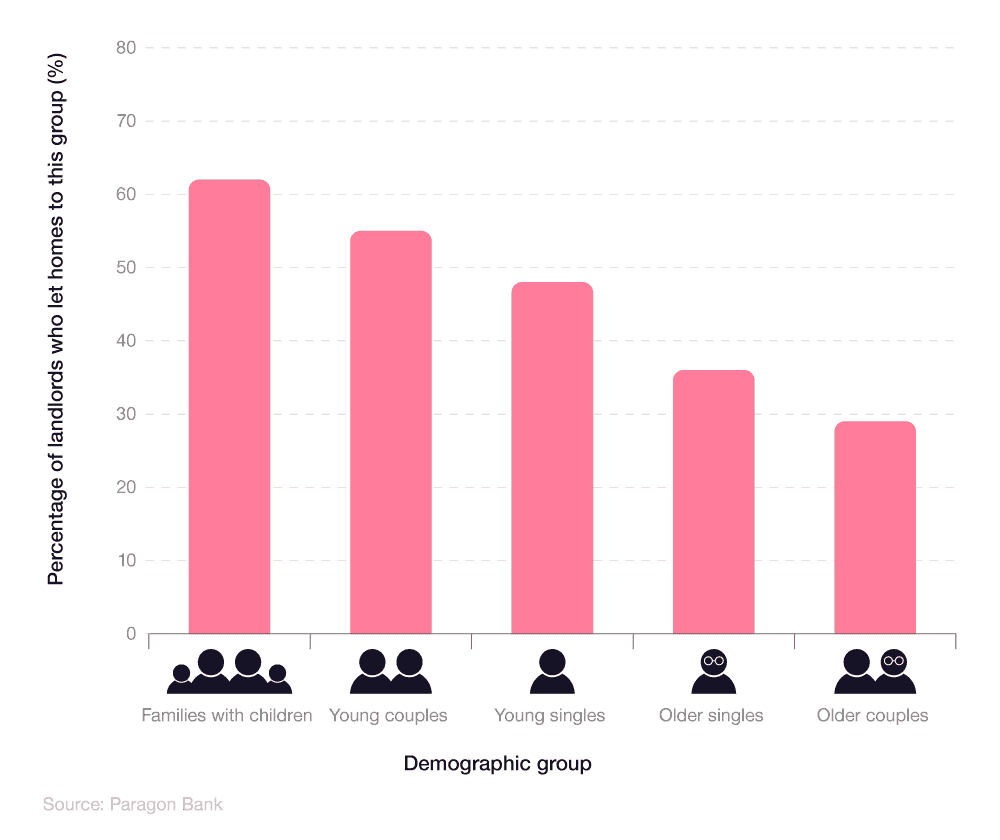

UK private rental population statistics

As of 2021-22, ONS figures suggest that 30% of all households in the private rented sector (PRS) included dependent children. This equates to around 1.3 million households.

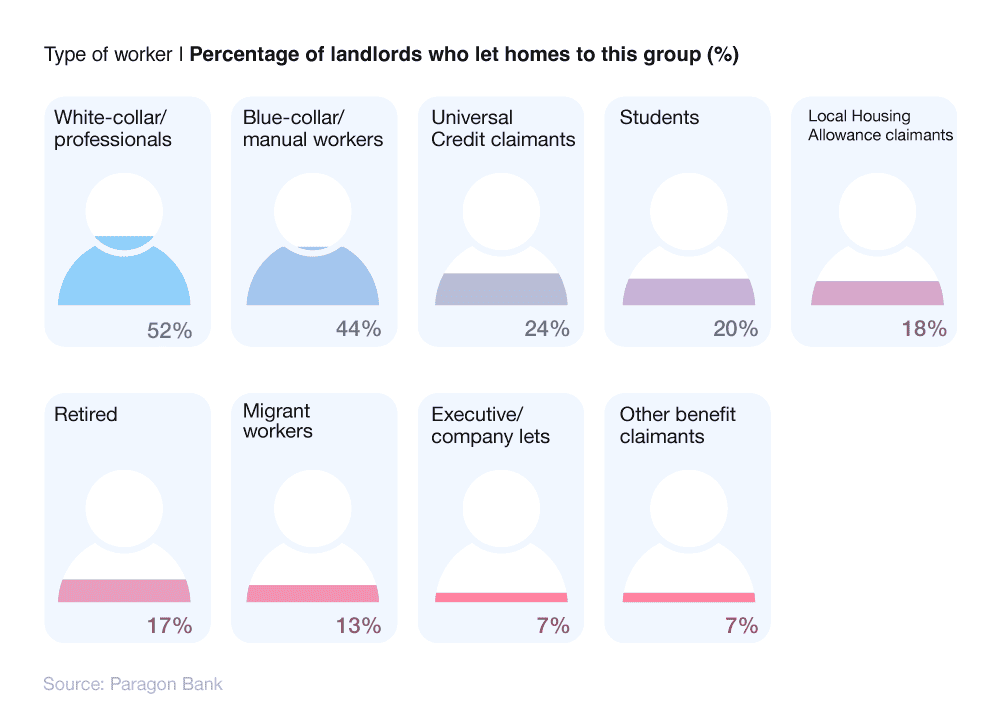

A breakdown of demographic groups and the percentage of UK landlords who let properties to them

Buy-to-let statistics show that UK landlords are more likely to rent accommodation to families with children, with more than one in six falling into this category. This is followed by young couples (55%) and young singletons (48%). Just over a third (36%) are older, single residents, with less than one in three (29%) coming from the older couples group—the least common.

A breakdown of different socio-economic groups and the percentage of UK landlords who let properties to them

UK landlords also provide homes to a wide range of professions, and socioeconomic groups across the country. More than half (52%) of tenants are from a professional/white-collar background and constitute the most common group. This is followed by manual workers/blue-collar workers at 44%.

Less than a quarter (24%) of tenants claim Universal Credit, and one in five are from the student population.

A breakdown of the percentage of landlords who reported having a positive relationship with their tenants

| Response to the survey | Percentage of respondents (%) |

|---|---|

| Positive relationship | 91% |

| Neutral relationship | 8% |

| Negative relationship | 1% |

(Source: Paragon Bank)

An overwhelming majority (91%) of UK landlords surveyed feel they have a positive relationship with their tenants. This might help to explain why 88% of landlords said they felt they had been very/extremely flexible with tenant requests.

Approved requests that were reported by landlords included:

Reducing rent during the COVID-19 pandemic

Upgrading broadband to meet the needs of tenants

Fitting new, high-end kitchen at tenant’s request

Adding a vegetable patch during Covid-19 lockdown

Wavering 18 months' worth of rent during COVID-19 and agreeing on a flexible repayment plan over the following two years.

8% felt the relationship they had with their tenants was neutral, and just 1% felt they had a negative experience with those renting their property.

When asked if tenants were happy with their current arrangements, Paragon found that the overwhelming majority (81%) were pleased with the property, and 85% were satisfied with their landlord. Tenants most appreciated not having the responsibility for repairs, maintenance, buildings insurance and/or ground rent costs.

A breakdown of the percentage of UK landlords who allow their tenants to keep pets

| Response to the question: “Do you allow tenants to keep pets?” | Percentage (%) of landlords |

|---|---|

| Yes, in some circumstances | 48% |

| Yes, in all circumstances | 13% |

| No | 39% |

(Source: Paragon Bank)

Around six in 10 (61%) of landlords surveyed said they allowed pets in their properties in some description. However, only 13% said they always allow tenants to keep animals. Just under half (48%) said they did, but only in some circumstances. Almost one in four UK landlords said they never allow renters to keep pets.

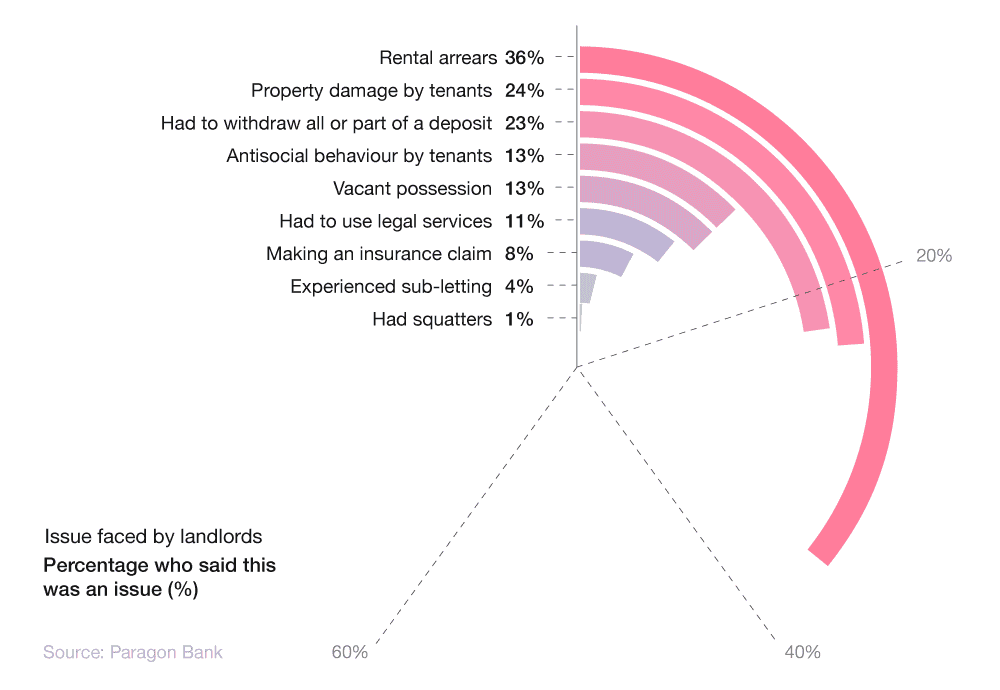

A breakdown of issues faced by UK landlords and the percentage who said they have had to deal with it

According to buy-to-let mortgage stats obtained from Paragon, over a third of UK landlords (36%) experienced rental arrears within the last 12 months. This was the most common issue faced by the landlord population within the last year.

Almost a quarter (24%) dealt with property damage by tenants, followed by 23% who had to withdraw all or part of a deposit.

13% had to either deal with antisocial behaviour from tenants or were in possession of a vacant property since 2021, with just over one in 10 (11%) forced to use legal services within the last year.

How does the private rental market in the UK compare with the rest of Europe?

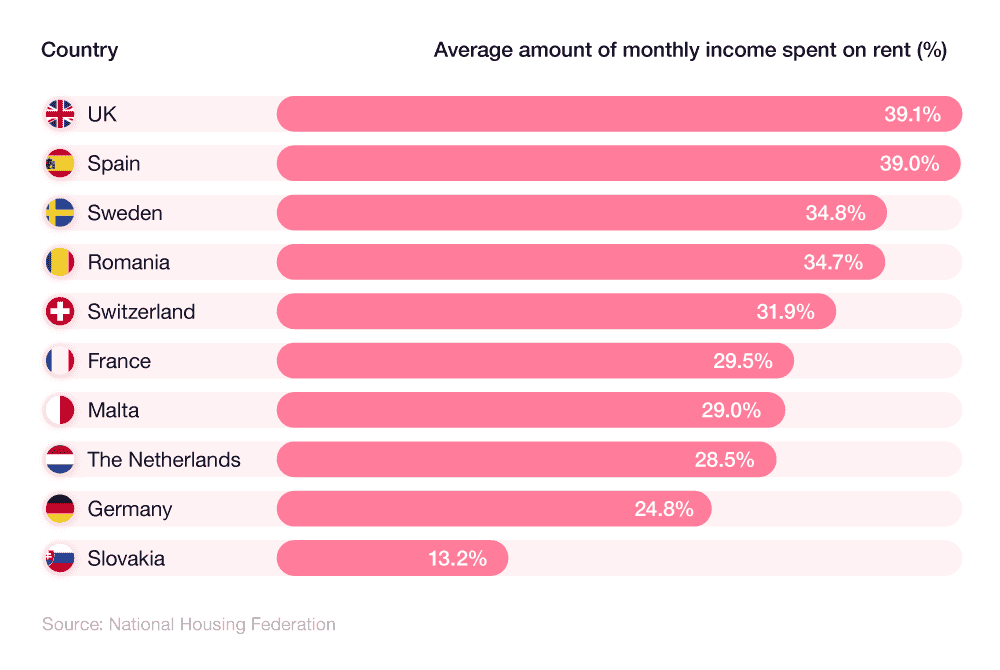

The latest UK rental statistics found that the average UK tenant spends 39.1% of their monthly income on rent – 11% more than the average across the continent.

This means that UK citizens spend more of their wages on rent than any country in Europe, with Spain (39%) spending at least 3% less of their monthly income.

A breakdown of the average amount of monthly income spent on rent in the UK vs other European nations

At the other end of the scale, tenants in Germany spent an average of just 24.8% of their monthly income on rent – more than 14% less than those in the UK. Slovakia had the lowest wages-to-rent ratio of anywhere in Europe, with an average of 13.2% at least 10% lower than any other country.

Looking for expert advice on the best ways to save for a mortgage? Our comprehensive mortgage guides section has advice on this and more.

UK rental market forecast

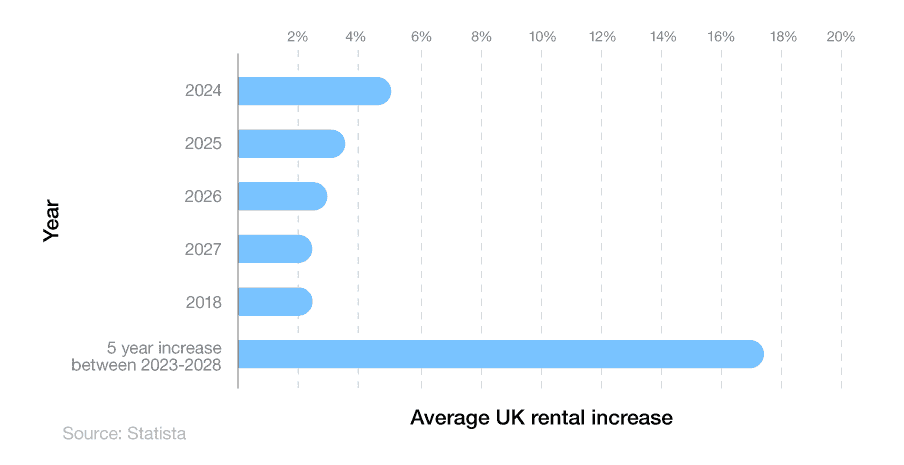

The latest UK private rental market anticipates further rental rises between 2023 and 2028. The average cost of private rent across the UK is forecast to rise by 5% between 2023 and 2024.

From her, average UK rent increases are projected to slow, rising by 3.5% in 2025 and 3% in 2026. Annual rental rises could fall to 2.5% in 2027 before dropping to 2% in 2028.

If projections are correct, rent prices may rise by an average of 17.6% between 2023 and 2028.

Private rental FAQs

What do you need for private rent?

The requirements for renting an accommodation can vary from landlord to landlord. Typically, most landlords will require documents that show your income and/or employment status, alongside copies of an identification document like a passport, birth certificate, or provisional licence.

Other common documentation landlords may require include credit references and employment or character references.

How much can a private landlord increase rent UK?

While there is no legal cap on how much a private landlord can increase rent, any landlord looking to increase rent must consider a few things.

Usually, landlords can not increase costs for tenants on a fixed contract until that contract expires. The only exceptions are if the contract states that mid-contract rises are allowed or the tenant agrees to a price change mid-contract.

For tenants on periodic contracts, you’re technically only allowed to increase rental prices once per year. The only exception would be if your tenants agree to further increases.

Finally, it’s important to consider fairness when reducing rental prices. Increasing costs far beyond the rate of inflation can not only cause stress and hardship to paying tenants but also runs the risk of pricing a property out of the market.

How much rent should I charge?

The amount of rent you should charge depends on various factors, from the condition of the property to its size, location, and value. A commonly accepted rule is that your rent should be between 0.8% and 1.1% of the overall property value. For example, if a property is worth £100,000, the rent would be between £800 and £1,100 per month.

What is the private rented sector?

The private rented sector refers to any home owned by private individuals (landlords) and rented out to member(s) of the public (tenants). This does not include government and state rental schemes like social and council housing.

Will rent go down in the UK in 2024?

Recent UK rental market statistics forecast that the average private rental costs in the UK are likely to rise by 5% in 2024.

What is the average increase in rent per year UK?

ONS data for January 2024 found that the average rent in the UK had increased by 6.2% over the previous 12 months. This figure was 6.9% when accounting for rent in London.

Can a private landlord kick you out?

Tenants can only be evicted during a contract with a court order. A court order is usually granted only in the event of contractual breaches from the tenant, such as defaulting on payments or causing damage or disturbance.

At the end of a fixed-term contract, a landlord can ask you to leave the premises provided he has given you ‘reasonable notice’. Most private tenants are entitled to at least two months' notice.

How can I reduce the cost of renting?

There are a number of options when renting a property that could help you reduce your monthly outlay. Renting a home with one or multiple flatmates is an effective way to divide your monthly outgoings and take away some of the financial burden. Renting an unfurnished property can be another good way to reduce your rent, while negotiating a break clause in your contract can give you an out if costs are getting unmanageable.

If it’s not possible to reduce your monthly rent, then switching your provider on household bills like gas and electricity to a cheaper provider is another way that you may be able to reduce your expenditure. You can find out more about switching your energy provider in our comprehensive guide.

How to save for a home deposit while renting?

As rent prices continue to rise, saving for a home deposit can feel unrealistic for many. Despite this, there are numerous ways you can monitor your finances more effectively as you attempt to get on the property ladder.

Savings accounts can be instrumental in helping you monitor your monthly spending and ensure you’re keeping aside the money you need to save for a deposit. Certain savings accounts like Lifetime ISA’s come with specific financial benefits that will help you save for a deposit quicker should you meet the terms of the account.

UK private rental statistics 2024 - Sources & methodology

Sources & methodology

https://www.statista.com/statistics/286512/england-number-of-private-rented-households/

https://www.paragonbank.co.uk/Resources/ParagonBlogs/MortgageBlogs/buy-to-let-report-2022

https://www.nrla.org.uk/news/epc-rules-for-rented-property-what-you-need-to-know

https://landregistry.data.gov.uk/app/ukhpi

https://www.propertymark.co.uk/resource/housing-insight-report-september-2022.html

https://www.rics.org/news-insights/market-surveys/uk-residential-market-survey

https://www.propertymark.co.uk/resource/a-shrinking-private-renter-sector.html

https://www.simplybusiness.co.uk/knowledge/articles/2022/06/rental-reform-white-paper-published/

https://www.generationrent.org/about_renting

https://www.rateinflation.com/inflation-rate/uk-inflation-rate/

Read more on UK private rental statistics 2024: