This type of loan enables businesses to borrow money and the lender doesn't require you to offer any assets as security.

Find the best loan for your business

Business loans are available to support you in different ways from covering shortfalls to fuelling growth

Funds in 24-36 hours

Trusted providers

Guided service

Startups welcome

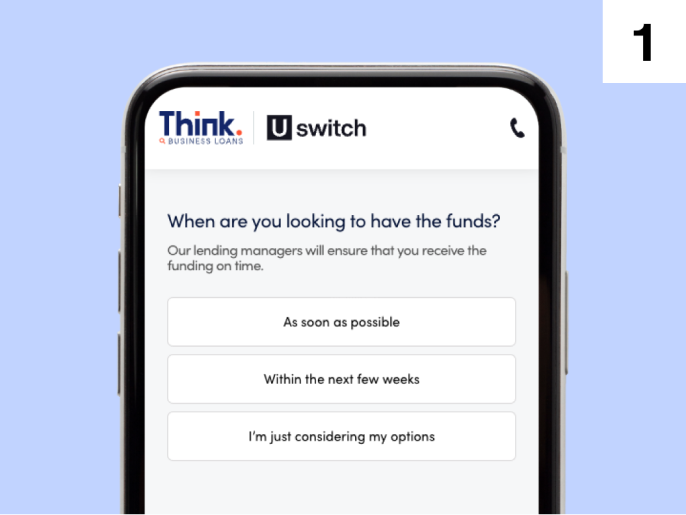

How it works

It's quick and easy to secure a business loan

Why Think Business

Think Business has been our trusted partner since 2021

The types of business finance available

![Unsecured business loans]()

Unsecured business loans

This type of loan enables businesses to borrow money and the lender doesn't require you to offer any assets as security.

![Bridging loans]()

Bridging loans

A bridging loan is for short term funding and it is mainly used on development and property projects, but it can also be utilised for business loan purposes.

![Asset finance]()

Asset finance

Asset finance solutions allow your business to borrow money against your assets based on their value. The assets could be machinery, IT equipment or fixtures and fittings.

![Secured business loans]()

Secured business loans

A secured business loan will ask you to provide assets as security to cover the amount being borrowed. For example, this could include company shares or property.

![Commercial mortgages]()

Commercial mortgages

This is a loan specifically for commercial property, for example an office building. The loan can be used to develop or refinance a property.

![Peer-to-peer loans]()

Peer-to-peer loans

A peer-to-peer loan is when your business borrows from investors rather than from a bank. This is normally arranged by a P2P lending platform.

The types of business finance available

Unsecured business loans

Bridging loans

A bridging loan is for short term funding and it is mainly used on development and property projects, but it can also be utilised for business loan purposes.

Asset finance

Asset finance solutions allow your business to borrow money against your assets based on their value. The assets could be machinery, IT equipment or fixtures and fittings.

Secured business loans

A secured business loan will ask you to provide assets as security to cover the amount being borrowed. For example, this could include company shares or property.

Commercial mortgages

This is a loan specifically for commercial property, for example an office building. The loan can be used to develop or refinance a property.

Peer-to-peer loans

A peer-to-peer loan is when your business borrows from investors rather than from a bank. This is normally arranged by a P2P lending platform.

Think Business is always on hand to help

Join the millions who have already switched.

More people switch their broadband and mobile with us than any other switching site.

Here's what some of our customers have to say:

Very quick and super easy.

Received email regarding special offer

Very easy to use