As the UK continues in its pursuit of reaching net zero emissions by 2050, the popularity of electric vehicles (EVs) continues to rise. With electric cars accounting for nearly a quarter (23.9%) of new car sales in the UK in 2023, the demand for fast, efficient, public EV charging points has never been higher.

But how is the industry coping with the increased demand? With nearly a fifth (18%) of people citing a lack of available public charging points as their main reason for not purchasing an EV, the development of the EV charging industry will play a crucial part in our quest for a greener society.

Uswitch’s research looks at the latest EV charging statistics for 2024, covering the EV charging market, EV charger speeds, cost, and more.

Top 10 EV charging statistics for 2024

The UK EV charging industry is projected to be worth £3.9 billion by 2030.

There were 61,232 public UK EV charging devices in April 2024 – up 53% from 2023.

Shell Recharge had the most public EV chargers of any company, with 8,698 charging devices.

Greater London is responsible for nearly a third (32%) of all public EV charging devices in the UK.

Around three-fifths (59%) of public EV charging devices in the UK have a power rating below 8kWh.

There are 4,988 ‘ultra-rapid’ public charging devices with power ratings of at least 150kWh, as of April 2024 – nearly triple the total from 2022.

Nearly a quarter (23.5%) of new cars registered in the UK from January to April 2024 were plug-in electric (including hybrid).

As of March 2024, the average cost of charging an electric car on a public network was 56p/kWH for chargers below 50kWh and 81p for those above 50kWh.

A third (33%) of survey respondents in London said they owned an electric car – 4% more than any other region.

There were approximately 1.1 million fully electric cars on UK roads, as of April 2024.

EV charging market statistics

The latest EV charging statistics show that the UK EV charging industry is projected to be worth nearly £3.9 billion by 2030. The industry is projected to grow significantly throughout the 2020s, rising from a market value of just under £488 million in 2022.

A breakdown of the total value of the UK EV charging industry in 2022 and the projected value in 2030

If current predictions are correct, it will mean that the value of the UK EV charging industry will rise by nearly 700% between 2022 and 2030.

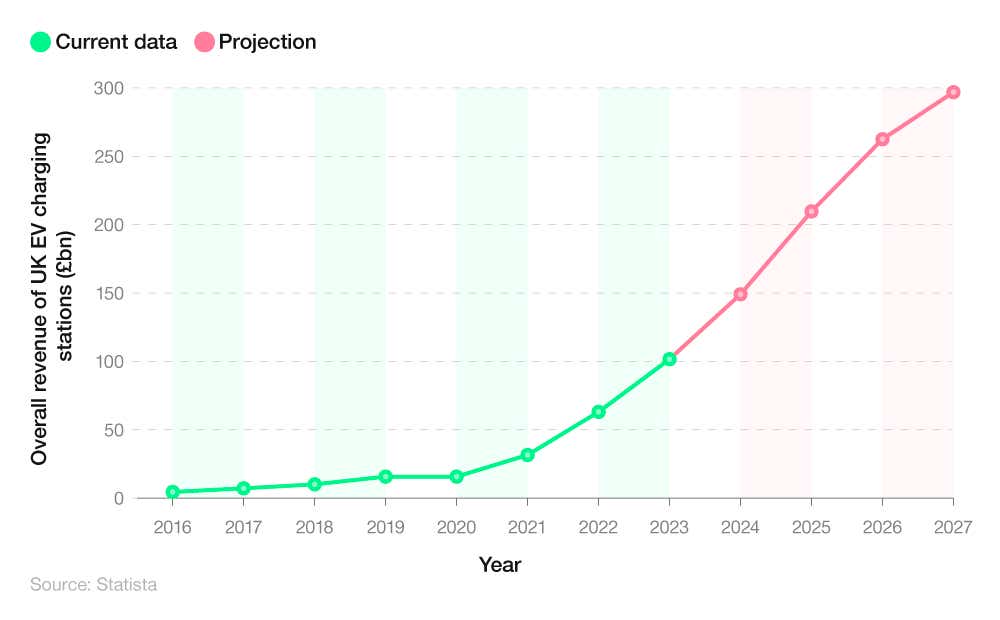

How much revenue does the UK EV charging industry generate?

Analysis of EV charging stats shows that industry revenue is expected to reach £149 billion in 2024 – up 46% from 2023.

Industry revenue grew consistently between 2017 and 2022. After generating £4.51 billion in 2016, the EV charging sector saw its earnings surpass £7 billion for the first time in 2017 – a year-on-year rise of nearly 59%.

A 41% rise between 2017 and 2018 saw earnings exceed £10 billion, before climbing to £15.71 billion in 2019 (+56%). Though revenue stagnated amid the 2020 COVID-19 pandemic, industry income doubled in 2021, exceeding £31.5 billion.

A breakdown of the total revenue of UK EV charging stations between 2016 and 2027

Another 100% increase occurred between 2021 and 2022, taking total UK EV charging revenue past £60 billion – a rise of more than 1,200% from 2016. Revenue growth is expected to slow from 2023 onwards, rising to around £102 billion in 2023 (+61%) before reaching £149 billion in 2024.

From here, increases are expected to slow further, with a 13% rise between 2026 and 2027, taking total industry revenue to £296.9 billion. If these projections are correct, it will mean that UK EV charging industry revenue will nearly quadruple (+370%) between 2022 and 2027.

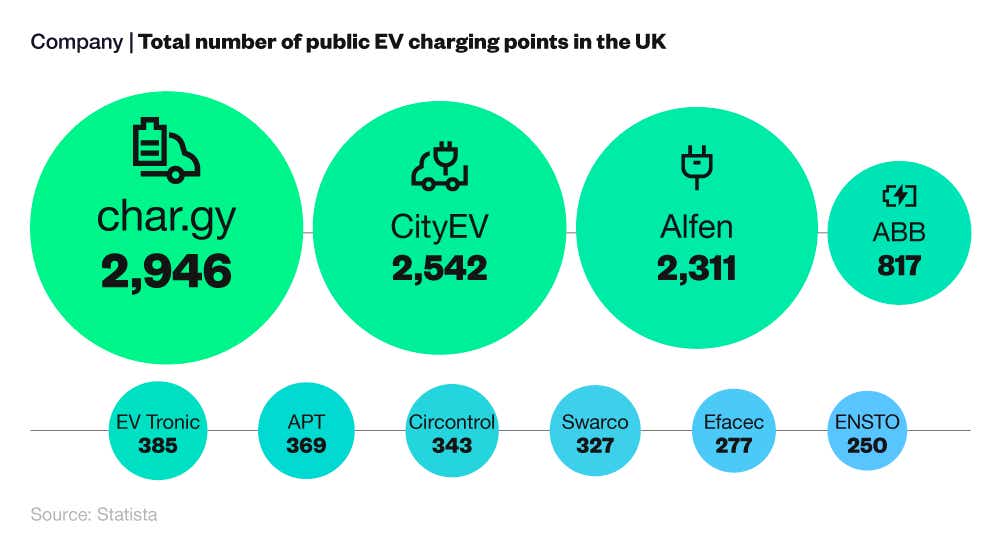

EV charger market share statistics

Char.gy has more public EV charging stations than any other company in the UK, with a total of 2,946 charging locations, as of January 2024. This is 16% more than any other company, making char.gy one of only three brands with more than 1,000 EV charging sites in the UK.

A breakdown of the companies with the most public EV charging stations in the UK

Though second-place CityEV had around 14% fewer charging stations than char.gy, their total of 2,542 was around 10% more than the next-highest company (Alfen) and the only other brand with more than 2,500 public EV charging points.

Rounding off the top five are ABB and EV Tronic, with totals of 817 and 385, respectively. Combined, this equates to less than half the number of stations provided by both char.gy and CityEV.

Uswitch’s guide on how to charge an electric car provides informed advice on charging your EV in an array of common locations.

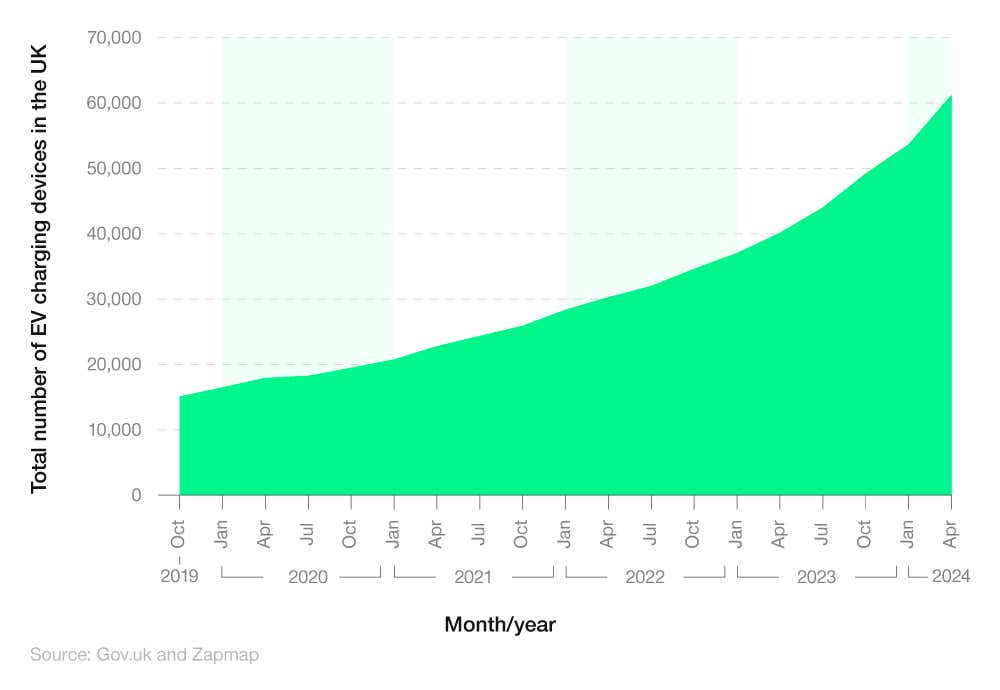

How many public EV charging devices are in the UK?

As of April 2024, there were 61,232 EV charging devices in the UK, representing a rise of nearly 53% from 2023. At the same time, there were 92,543 public EV charging connectors and 32,698 EV charging sites.

A breakdown of the total number of public EV charging devices in the UK between October 2019 and April 2024

The number of public EV charging devices has increased consistently since October 2019, when the total stood at 15,116. This number increased by more than a quarter (+29%) a year later before surpassing 20,000 for the first time in January 2021.

An annual increase of around 37% took the total past 28,000 in January 2022, with that figure exceeding 30,000 three months later (+7%). The total rose by a third (33%) in the year to April 2023, before climbing a further 48% by April 2024.

The latest figure for April 2024 means that the total number of public EV charging devices more than quadrupled (+305%) between 2019 and 2024.

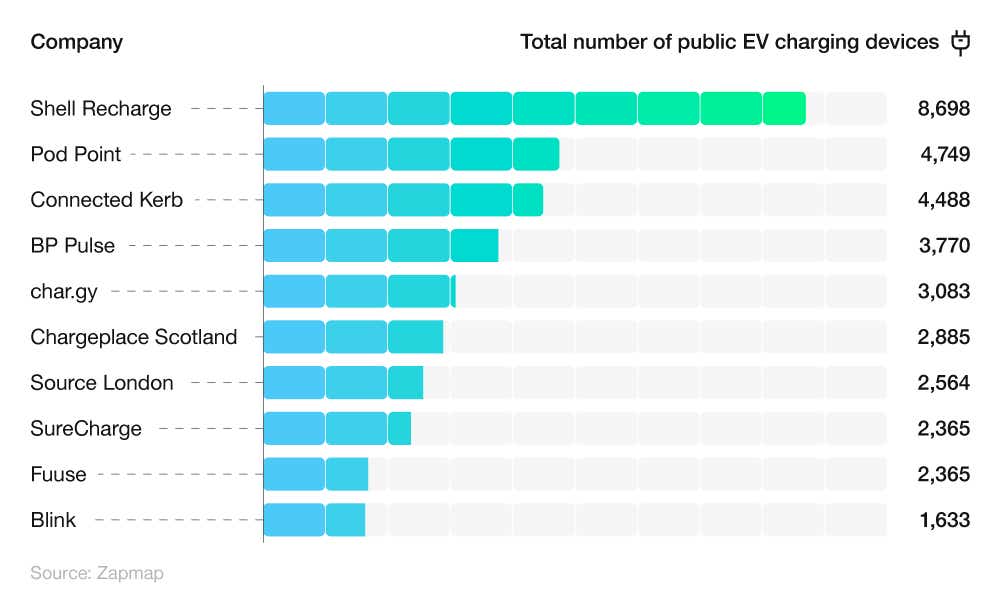

Which network has the largest number of EV charging devices?

Recent EV charging statistics show that Shell Recharge leads the way for the number of public EV charging devices in the UK. With almost 8,700 chargers, as of April 2024, Shell Recharge’s total is over four-fifths (83%) more than any other company.

A breakdown of the companies with the largest number of public EV charging devices in the UK

Pod Point had the next-highest total, with 4,749, making it the only other company with more than 4,500 public EV charging devices. This figure was 6% more than Connected Kerb and a quarter (26%) more than BP Pulse – the companies with the third and fourth highest totals, respectively.

The only other company with more than 3,000 public EV charging devices was char.gy. With a total of 3,083 devices, char.gy had 7% more chargers than Chargeplace Scotland but nearly two-thirds (65%) less than Shell Recharge.

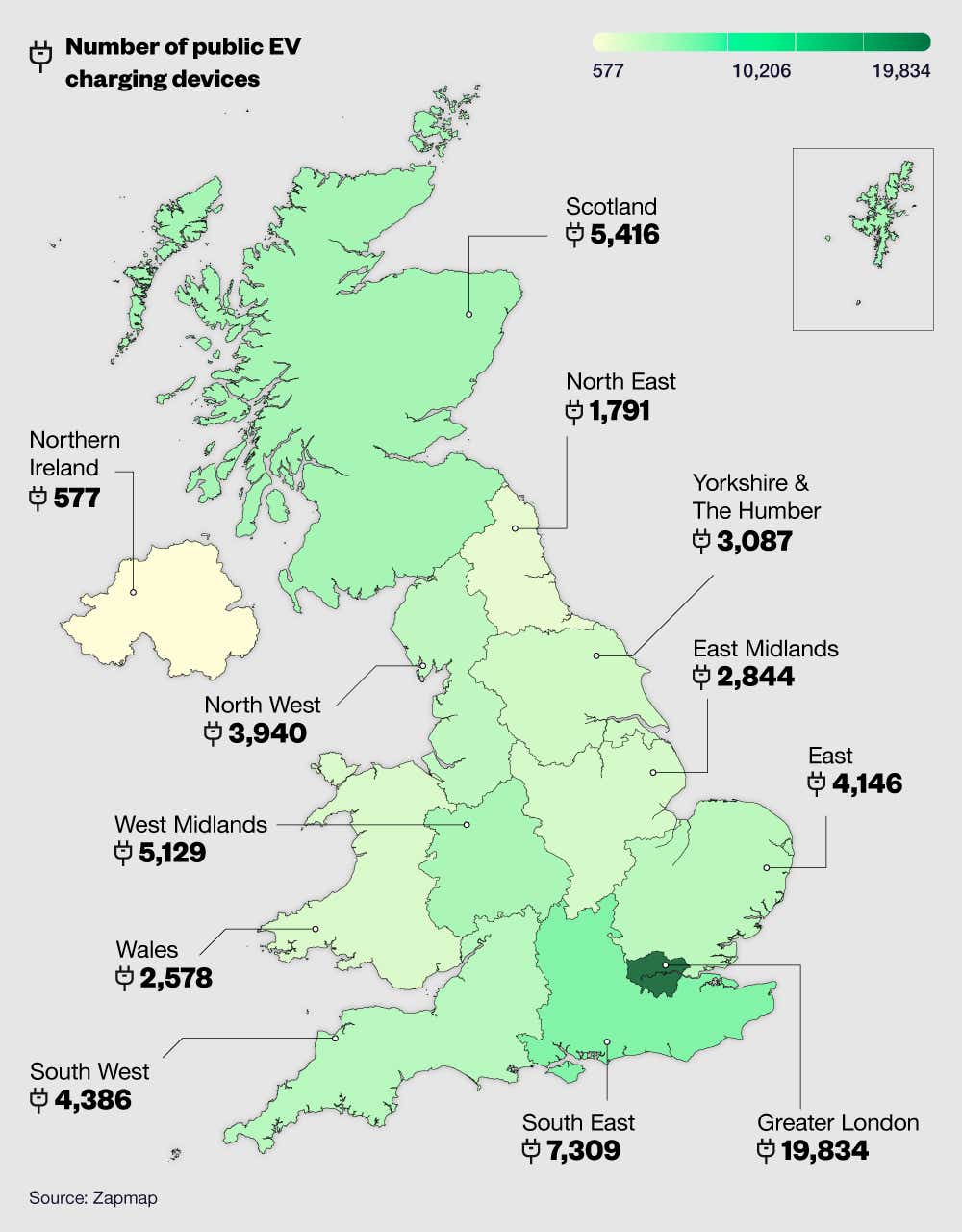

Which region has the most EV charging devices?

The latest EV charging statistics show that Greater London is the region with the most public EV charging devices in the UK. With nearly 20,000 devices at the end of April 2024, the English capital has more than double the chargers of any other region.

This also means Greater London is home to nearly a third (32%) of all public EV charging devices in the UK.

A breakdown of the UK regions with the most EV chargers in 2024

The South East has the next highest number of EV chargers, at 7,309. While this is nearly two-thirds (63%) less than London, it’s 35% higher than Scotland – the region with the next-most devices.

Northern Ireland’s total of 577 devices is by far the lowest of anywhere in the UK. This is 97% less than the number in Greater London and over two-thirds (68%) less than any other region. The North East was the only other region with less than 2,000 EV charging devices, with a total of 1,791 – around three-quarters (75%) less than the South East.

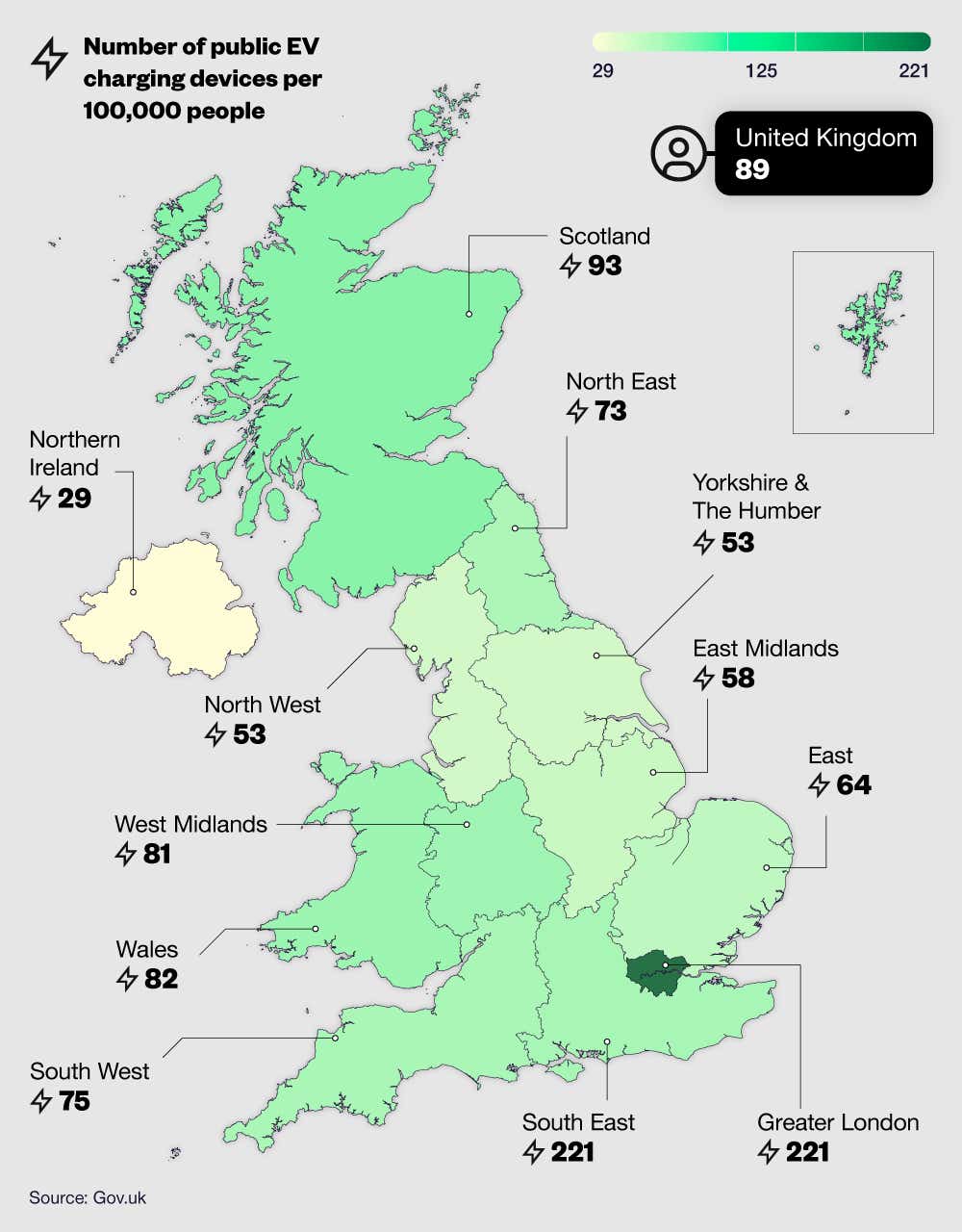

A regional breakdown of the number of the number of public UK EV charging devices per 100,000 people

At the start of April 2024, there were around 81 EV charging devices per 100,000 people in the UK. Regionally, London has the highest volume of chargers per population. The capital’s total of 221 per 100,000 people is more than double the total of any other region.

Following London is Scotland, with 93 devices per 100,000 people. This is 14% more than third-placed West Midlands (81) and makes Scotland the only other region with more charging devices than the UK, with an average of 89.

At the other end of the scale, Northern Ireland's total of 29 was 87% lower than London and 45% less than any other UK region.

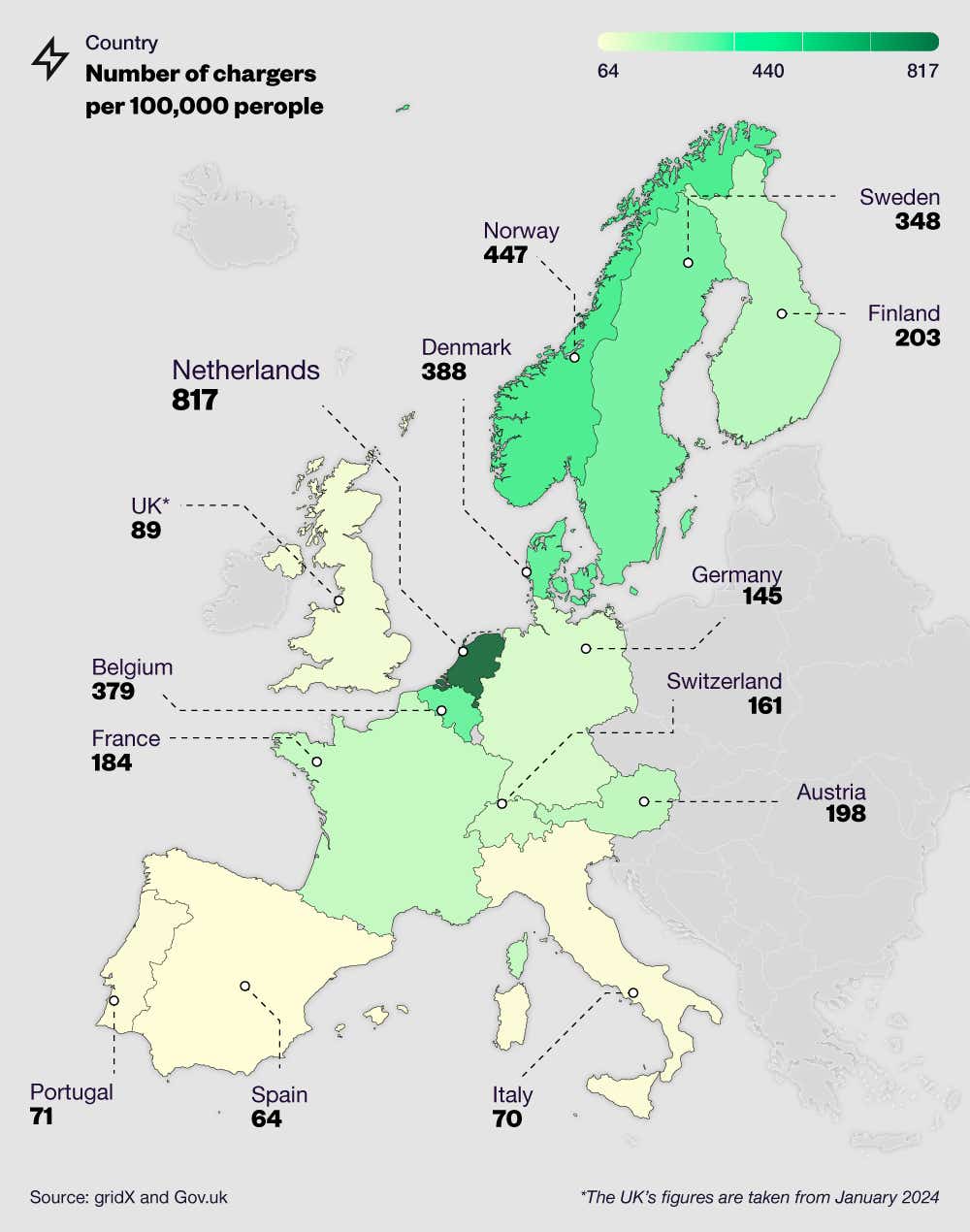

How does the number of EV chargers in the UK compare with the rest of Europe?

EV charging statistics from 2023 show that the Netherlands had the most EV charging devices per 100,000 people, at 817. This was 83% more than any other country covered and means that the Netherlands has nearly a charger for every 100 people.

The Netherlands was also named the best country to own an electric car in one of Uswitch’s previous studies, with the high number of chargers being a key factor.

A breakdown of the number of EV chargers per 100,000 people by European country (2023)

As of 2023, Norway had the second-highest number of chargers per 100,000 people (447). Though this was 45% fewer than the Netherlands, it was more than 15% greater than any other country.

There were three other countries in 2023 with at least 300 chargers per 100,000 people:

Denmark (388)

Belgium (379)

Sweden (348)

Even when looking at April 2024 figures, the UK’s total of 89 chargers per 100,000 people is only the twelfth highest of the European countries covered – 89% lower than the Netherlands but 27% more than Italy (70).

EV charger speed statistics

EV chargers in the UK are typically divided into four categories based on their power output:

Slow (3-7 kWh)

Fast (8-49 kWh)

Rapid (50-149 kWh)

Ultra Rapid (150+ kWh).

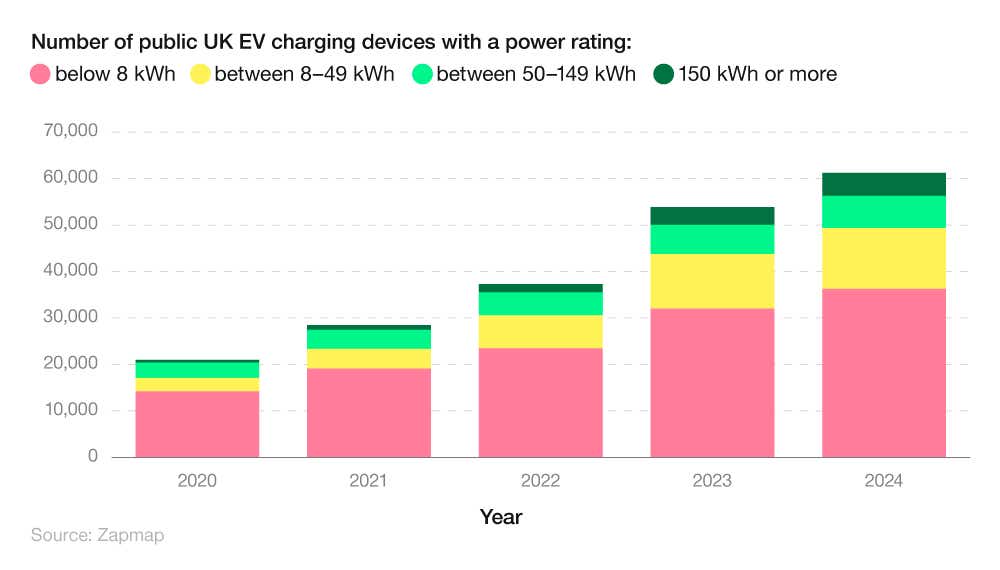

As of April 2024, more than 36,000 UK EV charging devices had a power rating below 8 kWh, accounting for almost three-fifths (59%) of devices. This represents a rise of 13% from 2023 and means that the number of slow EV charging devices has more than doubled since 2020.

A breakdown of the number of UK public EV charging devices by year and power level

‘Fast’ chargers with power ratings from 8-49 kWh are the next most common EV connector type, with over 13,000 devices in the UK. This is a rise of 11% from 2023 and means that fast chargers now account for over a fifth (21%) of all public charging devices in the UK.

Rapid chargers are the third most common charger type, with a total of 6,936 devices – more than double (+110%) the total from 2020. This means that rapid chargers now make up more than a tenth (11%) of public UK charging devices.

Ultra-rapid chargers make up the lowest portion of public chargers in the UK, with their total of 4,988 accounting for just over 8%. However, this is nearly nine times more (+787%) than in 2020 when there were less than 600 chargers of this type. Back then, ultra-rapid devices accounted for less than 3% of all public EV chargers in the UK.

Which companies have the highest share of rapid or ultra-rapid EV charging stations?

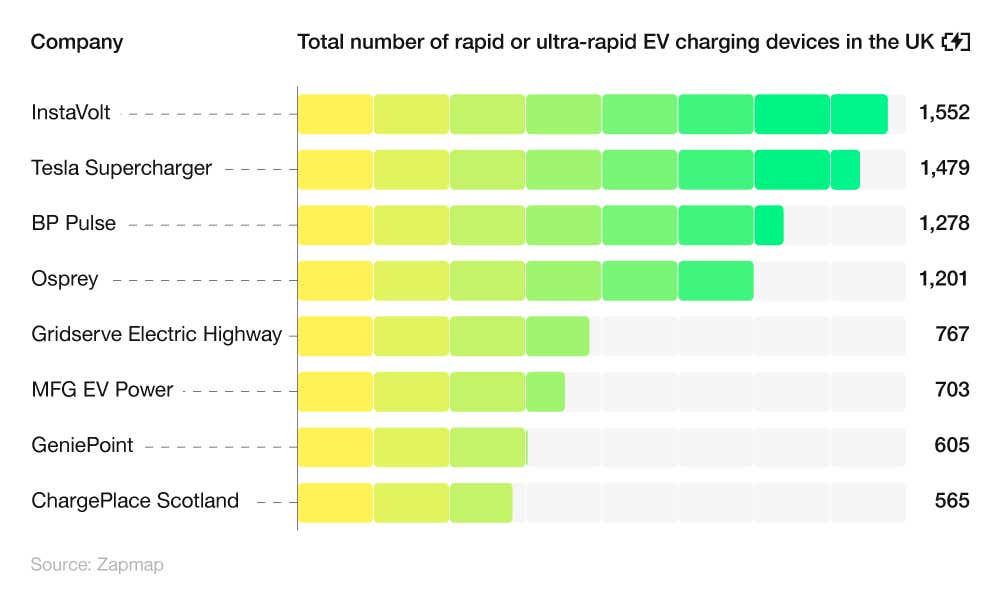

Recent EV charging statistics revealed that InstaVolt has the highest number of rapid or ultra-rapid EV charging devices in the UK. As of April 2024, the company had 1,552 high-speed chargers – 5% more than any other company and 13% of the overall market share.

A breakdown of the companies with the most rapid or ultra-rapid EV charging devices in the UK

Tesla Supercharger had the next highest number of chargers, at 1,479 – 5% less than InstaVolt but 16% more than third-placed BP Pulse (1,278).

The only other company with more than 1,000 rapid or ultra-rapid EV charging devices was Osprey, with 1,201 chargers – almost a quarter (23%) less than InstaVolt.

Combined, the four biggest companies are responsible for nearly half (46%) of all rapid and ultra-rapid public EV charging devices in the UK.

How much does EV charging cost?

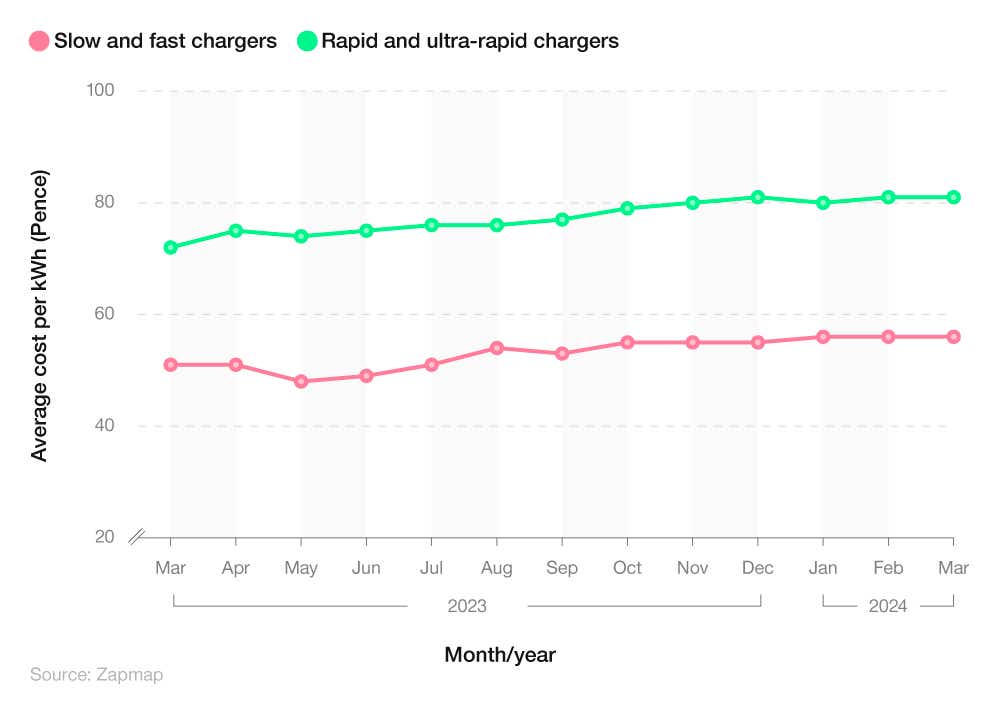

A March 2024 report from Zapmap found that the average cost of charging an electric car on a public network was 56p per kWH on slow and fast charging devices, equating to 17p per mile. This figure rose to 81p per kWh for rapid and ultra-rapid chargers – approximately 24p per mile.

A breakdown of the average EV charging cost by charger power from March 2023-24

The price of using all EV charger types increased between March 2023 and 2024. In March 2023, the average cost of using a slow or fast device stood at 51p per kWh, with this figure falling to 48p (-6%) in May.

By September, the average price rose 10% to 53p, before reaching 56p (+6%) in January 2024. The latest price for March 2024 means that the average price of using slow and fast EV chargers increased by nearly 10% over the previous year.

Fast and ultra-fast chargers have had similar price increases, starting at 72p per kWH in March 2023 before rising 10% by October (79p). Between November 2023 and March 2024, the average charging price fluctuated between 80p per kWh and 81p, with the latest figure for March representing a year-on-year rise of 12.5%.

Cost of running electric car vs. petrol in the UK

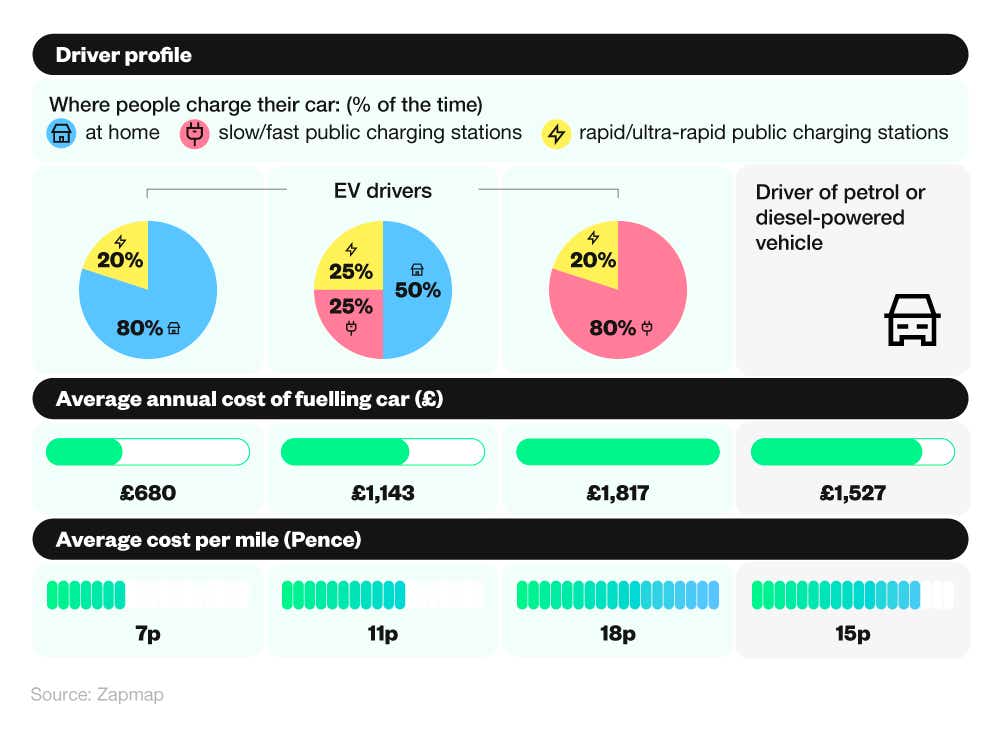

EV charging statistics from Zapmap compared four typical driver profiles to see how the cost of running an EV compared to fueling traditional petrol and diesel-powered vehicles.

EV drivers who charge at home 80% of the time, while using rapid and ultra-rapid public chargers 20% of the time, had the lowest average annual costs in April 2024.

These drivers typically paid £680 per year to run their car – less than half the average amount required to fuel a petrol or diesel-powered car (£1,527). This equated to an average cost of 7p per mile.

A breakdown of the average annual cost of powering a car by driver profile

EV drivers who charge at home 50% of the time, and switch between slow/fast and rapid/ultra-rapid chargers the other 50% of the time, had the next lowest costs. With average annual costs of £1,143 (or 11p per mile), this group paid a quarter (25%) less than petrol and diesel-powered drivers.

Conversely, drivers who charged at slow or fast stations 80% of the time, and fast or ultra-fast stations on 20% of occasions, paid higher fees than drivers of traditional fuel cars. These drivers paid average annual fees of £1,817 (18p per mile) – nearly a fifth (18%) more than those driving petrol or diesel-fueled cars.

Visit Uswitch’s EV charging guides section for expert advice on topics like charging an EV without a home charger.

How many home EV chargers are there in the UK?

An EV charging report from Whatcar estimated that there are over 400,000 home EV charging devices in the UK, as of 2023. This number is likely to have grown as EV car ownership continued to increase in 2023 and 2024.

The same report estimated that 80% of EV drivers charge their vehicles at home.

How much do home EV chargers cost?

The price of purchasing an EV charger can vary depending on the charger power, installation costs, and any additional equipment required.

A report from Checkatrade found that the average cost of installing a home EV charger was £1,000. This fee accounted for the parts and labour involved in the home EV charger installation process. However, with landlords and flat tenants eligible for a government grant of up to £350 for home EV chargers, that fee may be as low as £650.

A breakdown of the average cost of a home EV charger by charger type

| Charger type | Average cost |

|---|---|

| 3 kWh EV charger – supply only | £375 |

| 7 kWh EV charger – supply only | £625 |

| EV charger with installation | £1,000 (£650 for those eligible for a government grant) |

(Source: Checkatrade)

The average cost of buying an EV charging device depends on the power of the device you purchase. The average cost of buying a 7 kWh home EV charger is £625. This is two-thirds (66%) more than the typical cost for a 3 kWh charger (£375).

How much does it cost to charge an EV at home?

EV charging statistics from Podpoint found that the average cost to fully charge an electric car at home was £17 in April 2024. This was based on the average UK domestic electricity rate of 32 kWh and a typical 60 kWh electric car battery.

How many electric cars are there in the UK?

As of April 2024, approximately 1.1 million fully electric cars were on UK roads. This represents a rise of 13% from 2023 when there were just over 978,000 and is a two-thirds increase (66%) from 2022.

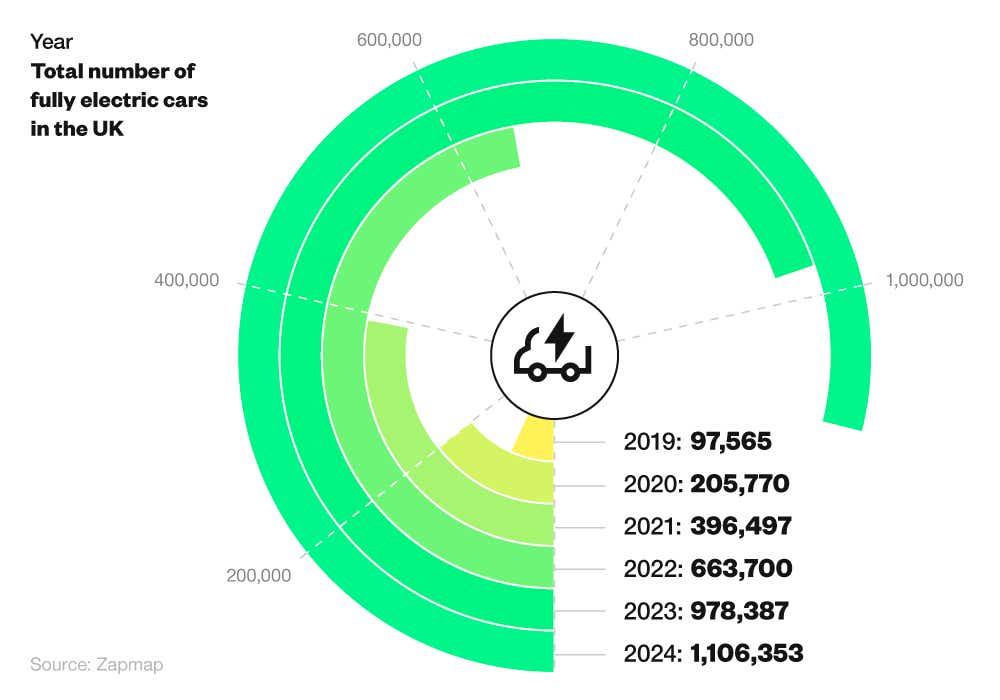

A breakdown of the total number of fully electric cars in the UK between 2019 and 2024

EV charging statistics show a substantial rise in electric cars since 2019, when there were less than 100,000 in the UK. From here, numbers more than doubled in 2020, surpassing 200,000 (+108%).

A 96% increase in 2021 was followed by a rise of more than two-thirds (67%) a year later, taking the total number of electric cars to 663,700. Since then, increases have slowed, rising by around half (47%) in 2023 before climbing 13% in 2024.

The latest figure for 2024 is the first time the number of UK electric cars has exceeded a million, representing a five-year rise of over 1,000%.

What percentage of new cars are electric in the UK?

As of April 2024, plug-in electric cars, including hybrids, accounted for nearly a quarter (23.5%) of new car registrations for the year to date. This is a fall of 0.4% from 2023, when electric cars accounted for 23.9% of all new cars.

An annual breakdown of the percentage of newly registered cars that are electric in the UK

| Year | Percentage of UK cars that are plug-in electric (including hybrid) |

|---|---|

| 2019 | 3.20% |

| 2020 | 10.70% |

| 2021 | 18.60% |

| 2022 | 22.90% |

| 2023 | 23.90% |

| 2024 | 23.50% |

(Source: Zapmap)

EV stats show a significant climb in the percentage of new electric cars between 2019 and 2024. In 2019, the overall percentage stood at just 3.2%, with this figure more than tripling in 2020 (10.7%).

A 7.9% rise in 2021 saw the percentage exceed 18%, with this figure rising to 22.9% a year later (+4.3%). The latest figure means that there were more than seven times the number of new electric cars registered in 2024 than in 2019.

Which region has the most electric car owners?

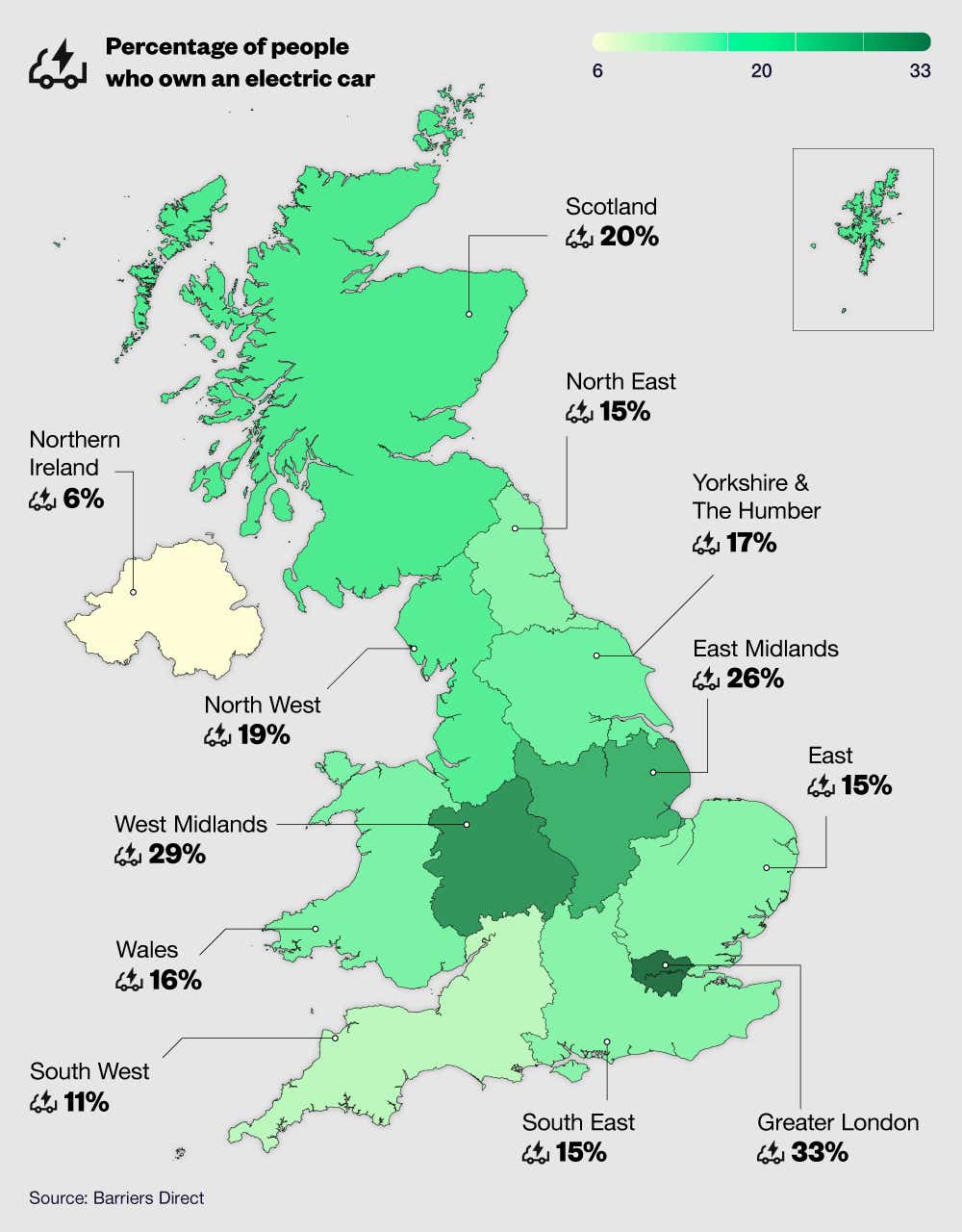

A 2023 survey from Barriers Direct found that Greater London leads the way when it comes to electric car ownership. A third (33%) of respondents from the capital said they owned an electric car – 4% more than any other region.

A breakdown of the percentage of UK electric car owners by region

London was followed by the West Midlands, where nearly three in ten (29%) residents were electric car owners. The East Midlands (26%) was the only other region where over a quarter of residents owned an electric car, compared to a fifth (20%) in Scotland.

At the other end of the scale, only 6% of respondents in Northern Ireland owned an electric car, making it the only UK region below 10%. This was just over half the total of the South West where 11% of respondents owned an electric car.

EV charging FAQs

What is EV charging?

EV charging refers to the replenishment of energy in an electric vehicle battery. This is done by plugging the vehicle into a relevant charger, either at home or at a public charging station.

How do I find EV charging stations?

Uswitch’s comprehensive EV charging map can help you find convenient charging destinations wherever you are. All you need to do is enter the postcode or the area you need a charger, and the tool will show you all the chargers in your area.

You can also use Uswitch’s filters to identify which locations have the type of charger you require.

How do I use EV charging stations in the UK?

Using an EV charging station is a simple process. All you need to do is locate the charger and park your EV beside the charger. From here, open your charging port and plug in the cable.

Note: If the charger does not have a cable, you’ll need to use your own charging cable, so it’s a good idea to keep one in your car.

How do I calculate EV charging cost?

To work out the cost of charging your EV, you need to take the size of your EV’s battery pack and multiply it by the electricity cost of your supplier.

For example, a car with an 80kWh battery being charged with a 30p/kWh public charger would cost £24 to charge fully from empty.

How do I pay for EV charging in the UK?

There are a few simple methods you can use to pay for EV charging:

Pay at the charging station payment terminal with a credit or debit card

Many charging stations now offer the option to pay at the terminal with a standard credit or debit card payment. While this option isn't available across the board, it’s becoming increasingly common with the majority of new rapid and ultra-rapid devices offering this service.

Download a mobile app that allows for EV charger payments

There are numerous mobile apps to download that provide helpful info on EV charging locations while simultaneously allowing you to track and make charging payments. One such example is the EV charging app from Zapmap, but there are others available that offer a similar service.

Use an RFID card or fob

A radio frequency identification card (RFID) allows for contactless, encrypted payment at EV charging stations. These cards are accepted by most providers of public electric car charging stations, including Ecotricity and Shell Recharge. Using these cards could not be simpler – just scan at the payment terminal in the same way you’d use a contactless bank card.

Numerous charging companies offer their own RFID card, which you can usually purchase online from their websites.

How many miles do electric cars last?

The mileage on an electric car can vary depending on the brand, model, and how well-maintained the vehicle is. Many manufacturers say that drivers should expect to get at least 10 years or 100,000 miles from an EV.

EV charging glossary

Electric vehicle (EV)

An electric vehicle is any vehicle powered by an electric motor that draws electricity from a battery. These vehicles are charged by an external power supply.

EV charging device

An electric vehicle (EV) charging device refers to the plug-in electrical device used to recharge electric vehicles. These chargers can either be installed at home or found at public EV charging stations.

EV charging station

An electric vehicle (EV) charging station refers to a destination where members of the public can charge their EV using charging devices. The quantity and power of devices may vary depending on the location.

Hybrid

In EV terms, a hybrid is a vehicle that uses an electric motor alongside a traditional fuel-powered engine like petrol or diesel. In hybrids, the two systems work together to power the vehicle, allowing the car to burn less fuel than a standard fuel-based car.

Net zero

Net zero refers to the amount of greenhouse gas that’s produced and removed from the atmosphere. If the amount of greenhouse gas removed is equal to the amount produced, then net zero is achieved.

Ultra-rapid charger

In EV terms, a rapid charger refers to any charging device with an output exceeding 150kWh.

Rapid charger

In EV terms, a rapid charger refers to any charging device with an output of between 50-149 kWh.

Sources and methodology

https://heycar.com/uk/news/electric-cars-statistics-and-projections

https://www.barriersdirect.co.uk/blog-posts/182-electric-car-ownership-and-charging-statistics

https://www.nextmsc.com/report/uk-electric-vehicle-ev-charging-market

https://www.statista.com/statistics/1411503/uk-forecast-electric-vehicle-charging-station-revenue/

https://www.statista.com/statistics/1446288/uk-ev-charging-points-by-leading-manufacturer/

https://www.zap-map.com/ev-stats/how-many-charging-points

https://www.gridx.ai/resources/european-ev-charging-report-2024

https://www.zap-map.com/ev-stats/charging-price-index

https://www.checkatrade.com/blog/cost-guides/electric-car-charger-installation-cost/

https://www.wagonex.com/blog/are-there-enough-chargers-uk-for-electric-cars

https://www.whatcar.com/news/best-home-ev-chargers/n25830

https://www.zap-map.com/ev-stats/ev-market

https://www.group1auto.co.uk/news/how-long-do-electric-cars-last